The RPO Market Is Doubling—But Most Enterprises Are Missing the Bigger Picture

The recruitment process outsourcing (RPO) market is undergoing a transformation that few enterprises anticipated. Valued at $45 billion in 2024, the market is projected to reach $82.73 billion by 2033—a 7.08% CAGR that's reshaping how enterprises think about talent acquisition.

But the real story isn't just the numbers. It's what's driving them: AI-powered automation, cost pressures, and a fundamental shift in how enterprises approach hiring at scale.

For companies still running recruitment in-house, this growth signals something important: the market has spoken, and enterprise AI agents are reshaping the economics of hiring.

Here are 7 ways this shift is changing enterprise hiring—and what you can do about it.

1. The Cost Equation Has Fundamentally Changed

Organizations adopting RPO solutions report cost savings of 20 to 40 percent compared to traditional in-house recruitment operations. That's not marginal—it's transformative for companies hiring at scale.

The savings come from multiple sources:

Technology consolidation: RPO providers spread AI and automation investments across clients

Process efficiency: Standardized workflows reduce time-to-hire by an average of 25%

Reduced overhead: No need to maintain large internal recruiting teams during hiring slowdowns

According to Strategic Revenue Insights' 2026 market report, recruitment service providers are stepping up investments in AI-driven platforms—and enterprises are responding with their wallets.

2. AI Is Now Table Stakes for RPO

The integration of artificial intelligence into applicant tracking systems, resume screening, and candidate matching has fundamentally changed what RPO providers can offer. Key capabilities now include:

Automated resume screening that processes thousands of applications in minutes

AI-powered candidate matching that identifies best-fit talent based on skills, experience, and cultural indicators

Chatbots and virtual assistants that handle candidate engagement around the clock

Real-time analytics dashboards on cloud-based platforms

These aren't future capabilities—they're table stakes for modern RPO. Enterprises that haven't adopted similar agentic automation in their own operations are increasingly finding themselves at a competitive disadvantage.

62% of employers report that AI-enabled platforms have shortened recruitment cycles by an average of 21 days.

3. The Talent Shortage Is Accelerating Outsourcing

The RPO boom isn't happening in a vacuum. It's directly tied to the global talent crisis. According to industry research, 77% of global employers reported difficulties filling roles in 2023—the highest level in 17 years.

When finding talent is hard, enterprises need every advantage. RPO providers offer:

Access to broader talent pools through established networks

Specialized expertise in hard-to-fill roles

Scalability during hiring surges without permanent headcount increases

This is why AI-powered HR solutions are seeing such rapid adoption—they solve the same problems RPO addresses, but with more control.

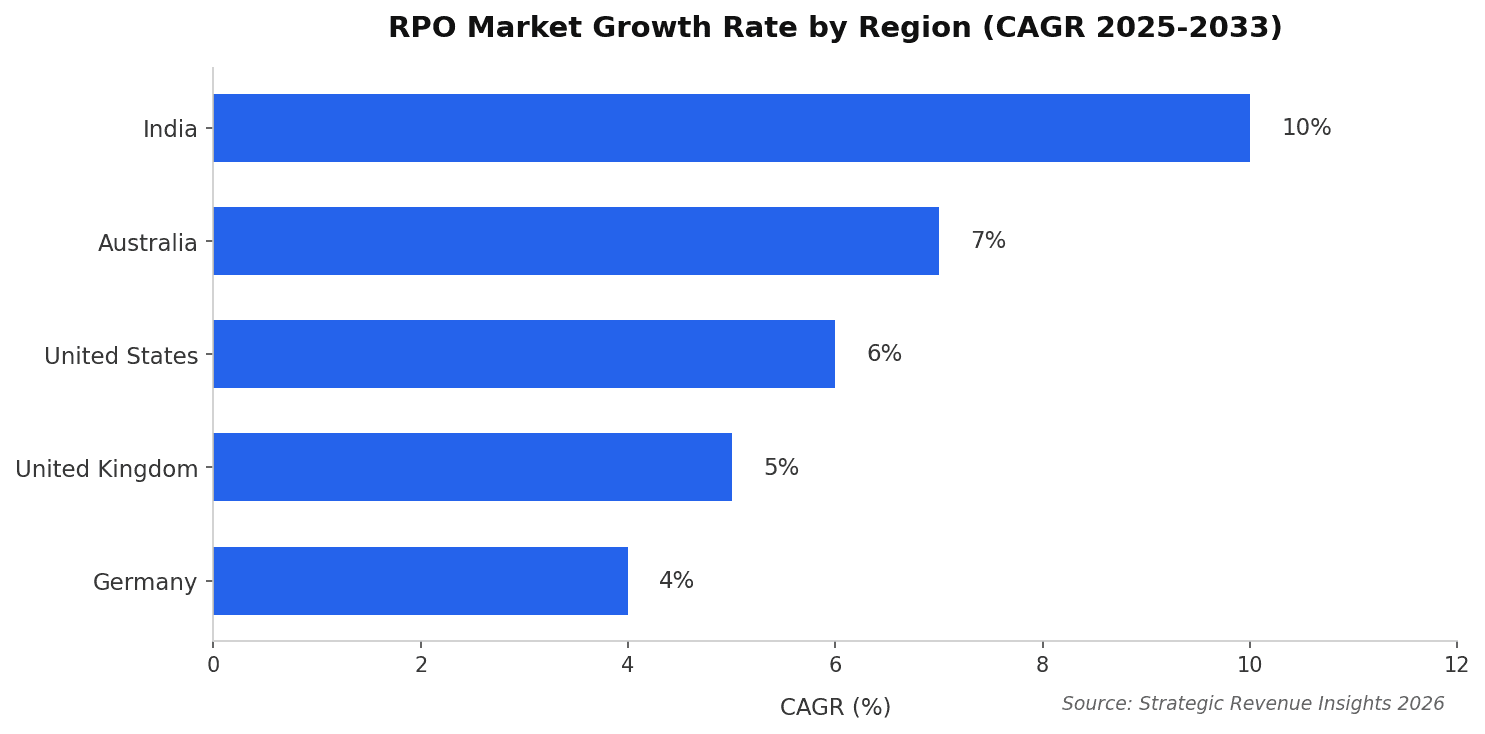

4. Regional Markets Tell Different Stories

Here's something most RPO coverage misses: the fastest growth isn't where the biggest markets are.

Source: Strategic Revenue Insights, RPO Market Report 2026

India's 10% CAGR—nearly double the US rate—signals where RPO innovation is heading. While North America and Europe remain the largest markets by volume, Asia-Pacific is where the growth is concentrated.

What this means for enterprises:

Expanding into APAC? RPO providers with regional expertise become strategic partners, not just vendors

Global hiring needs? The economics favor providers who can operate across high-growth and mature markets simultaneously

Compliance complexity? For companies navigating AI regulations in Europe, outsourcing to compliant partners reduces risk

5. The Build vs. Buy Decision Has Shifted

The RPO market's explosive growth reflects a broader trend: enterprises are increasingly choosing to buy capabilities rather than build them. This mirrors what we're seeing across enterprise AI adoption, where 76% of enterprises have stopped building AI in-house.

For recruitment specifically, the calculus is straightforward:

In-House: Significant upfront investment, ongoing maintenance costs, limited scalability, full control

RPO/AI Agents: Shared infrastructure costs, provider handles updates, scale on demand, control varies by model

The result: enterprises get better technology at lower cost—whether through RPO providers or their own AI agent platforms.

6. Hybrid Models Are Gaining Traction

Not every organization is ready for full outsourcing. Around 42% of companies now use hybrid models that combine internal HR teams with external RPO providers. This approach offers:

Retained control over strategic hiring decisions

Outsourced execution for volume recruiting

Flexibility to scale up or down based on business needs

The same hybrid approach works with AI agents: keep humans in the loop for final decisions while automating the screening, scheduling, and initial qualification work.

7. You Don't Have to Outsource to Get RPO Benefits

Here's what most RPO market analyses miss: the same AI capabilities driving RPO—automated screening, intelligent matching, workflow orchestration—are available to enterprises directly through AI agent platforms.

Consider the parallel:

RPO Providers: Use AI to process applications at scale, handle candidate engagement 24/7, provide analytics dashboards

Enterprise AI Agents: Deploy AI agents in your own recruitment workflows, automate screening and scheduling internally, full visibility into your own data

The difference is control. With your own AI-powered HR automation, you maintain direct oversight of candidate experience, data, and processes—while still capturing the efficiency gains driving the RPO boom.

The Bottom Line

The RPO market's trajectory from $45 billion to $82.73 billion tells a clear story: enterprises are betting heavily on AI-powered recruitment automation. Whether through external providers or internal platforms, the era of manual, paper-intensive hiring is ending.

The question isn't whether to automate recruitment. It's how—and who controls the automation.